Chinese money, the most beautiful in the world

MONEY, CREDIT CARDS AND INSURANCE

I don’t budget. My thinking is, if I have about $3000, it’s time to travel. If I want it to last, I can hang out longer in places like India or Indonesia. It’s another reason I like one way flights: I can just go home when I run out of money. Simple. Few people can or want to do it like that, but what kind of person are you? Are you disciplined with money? Are you always caught off guard that you need to take money out of an ATM?

Approximating travel costs and formulating a budget isn’t hard to figure out. Hostel and transport websites show how much sleeping and buses/trains cost, or check a guidebook and factor in that prices have risen a bit. Don’t forget you’ll be spending on tours, boat trips, scuba dives or big tattoos of TheDromomaniac.com across your chest. The variable that might be hardest to pin down is drinking. If you’re a party animal, the money can fly no matter where you are, and then late nights beget taxis and so on.

If contemplating a purchase, don’t always convert into dollars or euros as you can talk yourself into anything that way. Instead, think of what you can buy locally with the money. In Indonesia I can buy some hand-made batik table placemats as a gift and mail it to a friend for 100,000 rupiah, but with 100,000 rupiah I can buy ten incredibly delicious dinners in Ubud at a pretty place overlooking the rice paddies at sunset. Nobody gets gifts from me in Indonesia.

If you think you are going to save a ton of money by visiting CouchSurfing hosts as often as possible, they may very well want to go out to nice bars and restaurants or do some activities, so be prepared. It can end up costing nearly as much as if you stayed in a hostel and ate stuff from a supermarket, but the experience of visiting someone local will be worth it. Don’t subject everything to the monetary bottom line.

When starting out, try budgeting for a week at a time and see how far off the mark you are. If you are in a panic that the money might not last for your trip, remember that moving around always costs more than slowing down and spending more time in fewer places, which is good advice in general. Be flexible. Go to a beach or a smaller town or stay in the suburbs. So many trips people take are buzzsaw-fast. They blow through money and are in such a constant state of exhaustion that they need a vacation after their vacation.

Debit Cards

This is the way to go but have a backup plan if for some reason the card doesn’t work or gets sucked into the machine. Carry some emergency cash. Check with your bank about the fees associated with using your card at foreign ATMs, namely, are withdrawals charged at a straight percentage or a flat fee or worst, both? Right now I am using a Schwab card that reimburses all my ATM fees anywhere in the world I am. Very happy with it.

Keep the 24-hour telephone number for the bank or credit card company somewhere separate in case it is lost or stolen, or have it already in your Skype list of contacts.

Credit Cards

Credit cards only remind me of the world I want to leave behind, so it’s hard for me to muster much enthusiasm about this necessary evil, though I’m way stoked about Capital One because I’m able to pick the picture on my card.

I’m not a very good consumer to accumulate frequent flier miles or points with credit cards and it can be a tricky thing. It’s best not to constantly chase the best credit card deal by opening and closing accounts because this can be bad for your credit score. I see this often espoused, but I am glad I have the authority of the New York Times to back me up. In July 2012 I also wrote an extended blog post about the potential pitfalls of “churning”.

The whole thing is a racket (why should bad credit history be better than limited credit history?), so ideally, you will find something the first time that works well enough for you.

Nonetheless, sometimes your hand is forced because credit card companies can and do change the terms and your once-killer deal becomes a liability. Annual fees, dormancy fees, currency exchange fees–it’s a lot to keep track of.

Keep in mind that in many parts of the world, merchants in smaller shops and travel agencies often charge at least 3% extra to use a credit card to offset their costs of accepting it even though they aren’t supposed to.

Can you get by without a credit or debit card?

Aside from peace of mind in an emergency, there are only two main things you need a credit card for: flight tickets and ATM machines, but those are big things. It’s harder and more expensive to book flights with cash, and travelers checks are going the way of the dodo bird (though a friend recently in Thailand says she preferred using them). Only in Japan can you realistically and safely get away with carrying a ton of cash, just like the Japanese commonly do. Know the limit on how much Japanese can take out of their ATMs in a day? The equivalent of US$10,000!

Travel/Health Insurance

I’ve never had travel insurance. I have a deep mistrust of any insurance. This may be my irrational side which colors my views, but I believe an insurance company will find any excuse and resort to any gambit to deny coverage and that it will be endlessly frustrating to deal with them.

If you already have health insurance, check to find if you are covered abroad and precisely what for. It could only be for life-threatening emergencies, but that could be wide open for interpretation. Also find out the procedure the insurance company wants you to follow (translations of medical reports? reimbursements?) and what paperwork is needed should something happen.

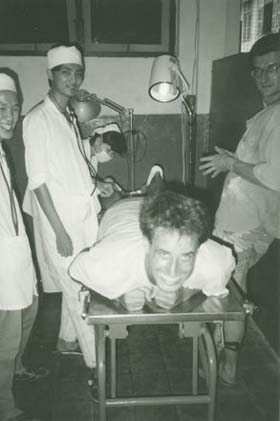

I go abroad for any operations if at all possible. I have had three elective surgeries in Hungary, one semi-emergency surgery in Denmark and as you can see in the photo here, one “minor operation” in a Vietnam hospital that made for a great story.

In California at an Iron Maiden concert someone threw a whiskey bottle and hit me in the head. It was five stitches in the local hospital, but I think I had insurance at the time. I only bring it up in case someone is googling “Iron Maiden and Estonian toilets”; I want my website to come up first.

I would very much like to hear anyone’s experiences with insurance companies, positive and negative.

A friend visiting me in Japan got into a fight with a surprisingly durable stalk of bamboo and had his arm slashed open. The school nurse almost fainted (“Kowai!”), so we went to the hospital. The only reason he had travel insurance was because the “be prepared” female friend he came with insisted on it before they left CZ. I think it was 17 stitches, costing something like $250. He paid upfront, took medical documents (all completely in Japanese), and turned them in once they returned to Prague. It took a couple months, but no prodding, no questions asked or answered, and he was fully reimbursed.

I took out a minimum policy (over $250) for six months in India, cost $115 with Atlas. Never had to use it but felt covered. Don’t have any here in Africa. I go back and forth on it.

I’m not careful, so the main thing I worry about is dying and my family being stuck with a $50,000 repatriation fee or whatever it is now. Talk about adding insult to injury!

Love you travel blog, cheers for putting out the right message about Couchsurfing in your ‘MONEY, CREDIT CARDS AND INSURANCE’ section. It’s good to see people spreading the word, how it should be spread 🙂

I’ve certainly found some of your tips quite useful, thanks.

I’m a cyclo tourist(a self-contained touring cyclist) from Thailand and no insurance. Early last year i rode in the Yourkshire, UK in the Dolby Forest and my break failed on the downhill and busted my knee badly and out of commision for a few weeks. I went to the local public health and got it Xray, bandaged up and given a pair of crutches and sent me out the door with zero cost. I thanks the uk public health. Oh, i returned the crutches before i left town and thank them. In my country it would be free also in a public health places and if i don’t have money i’m sure they’ll help me out, just ask!! Thanks for the post of info. Be safe. Happy trails.

Hi Kent,

I’m also not a huge fan of insurance companies (or banks, for that matter). But I wanted to let you and other fellow travelers know I discovered Mountain Pacific Bank in Washington State (US). They will reimburse all international transaction fees up to $20/month. If you don’t live in Washington (I don’t), it’s a bit of a hassle opening up an account (faxing info, notarizing ID, etc), but totally worth it to save on those pesky (a nice way of putting it) bank fees you get overseas.

Happy travels, Jessica

Thanks for the tip! That’s good to know.

Travel insurance is good if you get seriously ill abroad – there are sometimes stories of people in the paper appealing for cash to bring their loved ones home to British hospitals because they’ve had an accident on a motorbike and were to cheap to cough up £30 for insurance when they were booking their trip. An air evac is in the tens of thousands, and that’s before you have to pay for everything at the hospital on top – maybe it’s different for Americans, as you guys have to pay for every shot and bandage anyway, but it seems like a lot of money for a Brit. I have never had a problem with insurance claims – even the time I needed semi-elective (I needed it, but could have flown home) surgery and several specialist appointments. Stolen cameras, laptops – no problems. Of course, I might be eating my words when I get back to the UK this time and try to claim for the $1700 stolen from my hotel room in Nairobi – but that’s my employer’s insurance, not mine! (Yes, there was a reason I had that much cash, yes it was stupid to leave it in a locked hotel room – I just thought it would be more stupid to walk with it on the streets of Nairobi. To add insult to injury, I was pickpocketed on the way back from filing my report for the insurance with the police… chased the guy and couldn’t catch him: thanks, good citizens of Nairobi for stepping it to help that middle aged white woman shouting “Stop thief.” Not. I hope you enjoyed the afternoon’s entertainment and didn’t mistake my passing for an earthquake. Ahem) Good insurers if you are UK based are Endsleigh (discount for students and educational employees) – they may seem a little pricey comapred to some (but are cheaper than STA and other established companies) but in fifteen years have NEVER let me down – they’ll even pay your hospital bills direct, and let you reverse the charges. Repatriating a body to the UK from the Middle East costs about £8k – reason enough to take out insurance for me: bad enough you get killed going where your parents told you not to, without them having to pick up the bill 🙂

I forgot to add – so busy was I ranting – that Endsleigh paid to air evac my brother out of the Namibian desert to hospital in Windhoek after a serious car crash, offered to fly my mother to Namibia, and ultimately flew him home from SA several weeks later when he realised he wasn’t really well enough to keep travelling. Via Business Class on BA, so that his back wouldn’t suffer too much on the journey. Gap Year travel insurance – less than £50 at the time: and I’m not even getting a cut for plugging them!

Bottom line – accidents can be expensive, and being accidents, it’s hard to plan for them: if you have private health insurance, you might be covered overseas – but if you’re not, I really, really recommend insurance, unless you’re seriously loaded and have a big credit limit on your cards. And if you’re British, the consular services will help get money to you (ie your family get it to them in London and you can pick it up overseas): but they will not pick up your tab, (even if you have died and your ailing mother living on benefits in Rotherham wants the body of her only child home: sadly, a true story).

Thanks for your comments. Both were very interesting to read. It is good to hear you haven’t had any claims problems yet, and I hope you don’t with your most recent one.

It’s always a tough decision whether to keep your money in the room or to have it on you and I can imagine your frustration of how the events unfolded with the pickpocket. I might have gone on a shooting spree.

We really need to get into the discount body repatriation business. 8000 pounds?!

All I’d like to say is… Basically, my Uncle.. THE KING.. Kent Foster!.. Is the coolest man alive!!! 🙂

Yes, I am TheDromomaniac’s 4th niece! AKA.. “THE KING’s Niece!”.. It’s good to be related to the famous:)

The reason I have travel insurance is because if I don’t, I won’t get my visa!

Well, that and the horror stories such as the kid I went to high school with who died in Thailand suddenly and his family had to run fundraisers to get his body home – $30,000 Australian dollars, in 1999. Ouch.

My partner was ill with the worst kind of food poisoning 8 years ago and his medical bills came to thousands as he had to spend 10 days in a Singapore hospital – too ill to fly home – on a drip, etc… And it was free insurance from a credit card that he used to book the flights! Could not fault the service of the insurer – hospital stay, hotel for recovery, ambulances, medication, new flight home.

Now that I mention it… The credit cards that offer insurance are good deals to look for – we have a debit card that we bought our flights on and it gave us 6 months of insurance – we just added on more for the extra time that we are away. Worth shopping around for – there are many Australian-issued cards that provide this perk.

Why did you get 3 operations in Hungary? Is there something about having operations there that is magically more awesome than anywhere else? Curious …

Due to some unfortunate side effects of Lariam (NEVER TAKE THIS SHIT!) combined with a salmonella-typhoid infection (yes, i was vaccinated!) I ended up in the most costly hospital of Kathmandu. I had to stay for 10 days in order to fully recover. Had i not taken out a travel insurance (30EUR per month) it would have costed me over 10.000EUR.

It was only because i was cycling that i decided to take out a proper insurance.. Lucky me! I am convinced of it’s usefulness : )

i like the way you express yourself:

Dodo bird

LMAO:)

I once left a huge amount of cash in the hut of the person managing a national park in Madagascar, as it was more foolish to camp for few days with that amount. I gave the impression that the plastic bag of clothes I left was just that — dirty clothes. He could have gone through them for all I know but cash was hidden somewhere.

I travel with very little cash wherever possible (and when I do have cash, it’s hidden in various places that are not obvious money-hiding places). And yes, debit card’s the way. Compared with credit card, the fees are much lower. There were instances when these plastic cards had failed me(happened to me twice!) and needed to request someone from home to wire me money. All I’m saying is be prepared for major possibilities. When I first started, I followed people’s advice on use of money belt. Did it once and vowed never to do it again. It’s prominent (supposed to be not), uncomfortable and too much of a hassle. And it’s not like thieves will not pat you down if you encounter them.

In general, I don’t believe in insurance but when traveling outside the country, I try to get even a cheap one. I don’t want my family to have problems with getting my body when they do find out where I went and what I did.

Hi Kent, your blog is very detailed and helpful! I was looking for info like this!

Thanks! Maybe my no-insurance stance is irresponsible.

I see you have a new website. Good luck with it!